Reminder – – VOTE on TUESDAY, November 4th

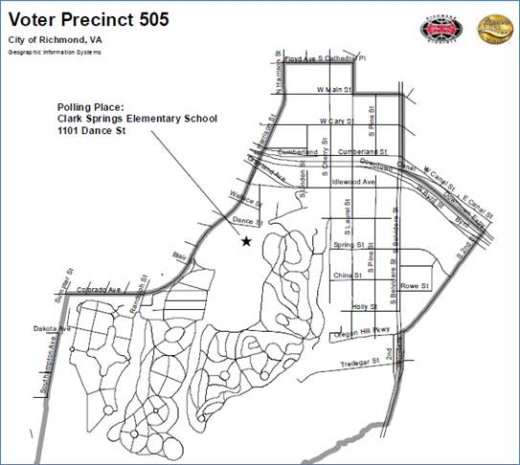

Polling location: Clarke Springs Elementary School

1101 DANCE STREET

RICHMOND, VA 23220-6112

6:00am – 7:00pm

MUST bring photo identification

Candidate Details:

Office Jurisdiction Ballot Name Party Web Site

United States Senate Statewide Ed W. Gillespie Republican http://www.edforsenate.com

United States Senate Statewide Mark R. Warner Democrat http://www.markwarnerva.com

United States Senate Statewide Robert C. Sarvis Libertarian http://www.robertsarvis.com

Member House of Representatives – 03 03 Robert C. “Bobby” Scott Democrat http://www.bobbyscottforcongress.com

Clerk of Court RICHMOND CITY Edward F. Jewett Democrat http://www.jewettforclerk.com

Clerk of Court RICHMOND CITY Emmett J. Jafari Independent Facebook: Emmett Jay For Clerk

Constitutional Amendment:

Explanation of Proposed Constitutional Amendment

The proposed amendment would authorize the General Assembly to exempt from taxation the real property of any surviving spouse of a member of the U.S. Armed Forces who was killed in action, as determined by the US Department of Defense. The exemption would apply to the spouse’s principal place of residence even if the surviving spouse moves to a new principal address within the Commonwealth. The amendment does not require the surviving spouse to have been residing in the Commonwealth at the time the veteran was killed in action. The exemption would end if the spouse remarries.

A “yes” vote will make effective legislation exempting from real property taxation (real estate tax) the principal residence of the surviving spouse of any member of the US armed forces who was killed in action.

A “no” vote will leave the Constitution unchanged.

Yes – For the Measure Proponents say: 1. The exemption assists families of armed forces members who gave their lives for their country. 2. As a constitutional amendment this exemption is permanent.

No – Against the Measure Opponents say: 1. As an open-ended, unfunded mandate on localities, the governmental unit that regulates, imposes and collects the real property tax, it will reduce localities’ revenue with no compensating revenues to locally fund services. 2. A constitutional amendment does not allow any flexibilities if the Commonwealth’s financial circumstances change in the future.