On Monday, February 10th, the Richmond City Council will vote on giving Venture Richmond a tax exemption for its real estate on the site of its proposed amphitheater below Oregon Hill. City Council should not approve this tax exemption for Venture Richmond for the following reasons:

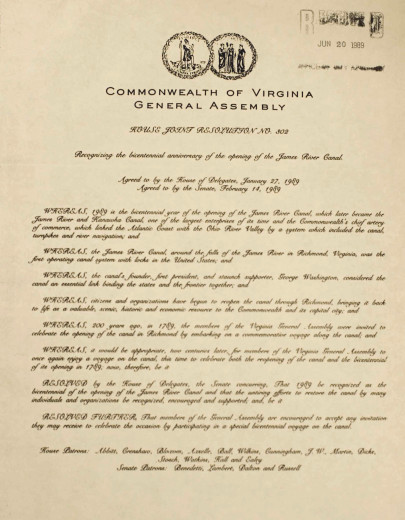

The City Council has a moratorium on granting tax exemptions by designation. Venture Richmond submitted this application in 2012, and Venture Richmond failed to meet the deadline of April 8, 2013, as established by City Ordinance 2013-19, for introducing an ordinance exempting property from taxation by designation.

State code requires that City Council consider whether the executive salary of the organization is reasonable when considering an organization’s application for tax exemption. Venture Richmond Director Jack Berry receives a salary of over $240,000 annually. If Venture Richmond can afford to pay its Director $240,000 are we to believe that it cannot afford to pay $43,836 in real estate tax?

State code also requires that City Council consider whether the non-profit applying for tax exemption engages in substantial lobbying for legislation. According to Venture Richmond, it has spent at least $32,000 lobbying for the Mayor’s Shockoe Stadium proposal. The Mayor is President of Venture Richmond, and Venture Richmond has been engaged in substantial lobbying for the Mayor’s legislation.

Richmond’s Tax Exemption by Designation Committee recommended AGAINST a real estate tax exemption for Venture Richmond, and the committee sessions generally focused on the amount of executive salaries, revenue sources and any duplication of city services being performed by each applicant. The other organizations that applied but did not receive exemptions were VMFA parking lots, Science Museum of Virginia properties, Family Lifeline properties, CHAT Property, Hands Up Ministries properties and Richmond Urban Senior Housing property.

On its application for real estate tax exemption for its amphitheater property, Venture Richmond stated that the property was in compliance with zoning codes. Yet the amphitheater above the canal is not zoned for an amphitheater. Venture Richmond also stated that it does not compete with other organizations in the marketplace, a contention that is disputed by private promoters. Venture Richmond also stated that it does not provide or deny services based on ability to pay, a contention that would be disputed by those not affording a ticket to Venture Richmond paid events.

According to a video-taped presentation given by Venture Richmond Director Jack Berry to the Oregon Hill Neighborhood Association, the intention of Venture Richmond is to rent out the amphitheater with no limitation on the number of events annually, and to serve alcoholic beverages on the property. Rental property generating income for the non-profit is generally not considered a charitable purpose for tax exemption.

I will be very interested to see how other local media covers this issue. Joined corporate and political power in Venture Richmond’s board that runs roughshod over citizen concerns is a real problem, whether the issue is the Tredegar Green amphitheater plan or the Shockoe stadium proposal.